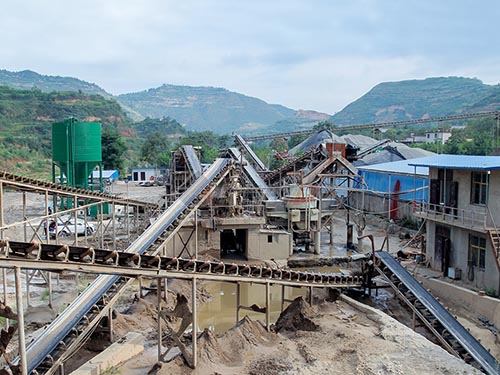

Complete Crusher Plant Investment In Russia

Strategic Foundations: Navigating Complete Crusher Plant Investment in Russia's Evolving Market

Russia's vast territory holds immense mineral wealth – from the iron ore heartlands of the Urals and KMA to coal reserves in Kuzbass, gold in Siberia, apatite on the Kola Peninsula, and extensive deposits of construction aggregates like granite, basalt, and limestone scattered across its expanse. Unlocking this potential efficiently hinges on robust processing infrastructure at the very source: the crushing plant. Investing in a complete crusher plant within Russia represents a significant capital commitment intertwined with complex logistical, regulatory, and operational considerations. This article delves into the critical aspects shaping such an investment decision today.

The Compelling Market Drivers

Several powerful forces converge to make crushing plant investment relevant:

1. Infrastructure Development Imperative: Despite geopolitical shifts, Russia maintains ambitious goals for domestic infrastructure renewal – roads (including projects like the M12 highway linking Moscow to Kazan), railways (modernization of Trans-Siberian routes), bridges, ports (expansion in the Far East and Arctic), urban development in major cities like Moscow and St. Petersburg plus regional hubs like Yekaterinburg or Novosibirsk.

2. Domestic Resource Focus: Sanctions have intensified efforts towards import substitution across industries and bolstered domestic resource extraction to fuel internal manufacturing and construction sectors.

3. Mining Sector Resilience: While facing challenges related to export markets for certain commodities like coal or nickel due to sanctions pressure points exist especially concerning EU markets previously significant buyers Russian producers are adapting seeking new markets Asia Middle East Africa while simultaneously focusing more intensely on domestic consumption needs particularly within construction materials segment which remains vital locally driven activity less susceptible international trade restrictions directly impacting finished product demand within borders itself thus requiring reliable aggregate sand gravel production capabilities nationwide scale supporting housing commercial projects alike nationwide scale requiring reliable aggregate sand gravel production capabilities nationwide scale supporting housing commercial projects alike.

4. Modernization Needs: Many existing crushing facilities are aging or inefficient technologically speaking leading higher operating costs lower yields poorer product quality compared modern standards creating opportunity replacement upgrades significantly improve profitability environmental compliance through reduced dust noise emissions better energy efficiency overall operational effectiveness meeting stricter environmental regulations becoming increasingly prevalent globally including within Russian Federation context where enforcement tightening gradually albeit unevenly across regions depending local priorities capacities oversight bodies involved permitting process itself often lengthy complex requiring careful navigation expertise local knowledge essential success navigating bureaucratic hurdles effectively minimizing delays costly mistakes during planning execution phases project lifecycle management strategy implementation plan development stage critical path analysis becomes indispensable tool ensuring timely completion commissioning facility